User Guide — Claim Submission

User Guide — Claim Submission

athenahealth will submit at least 95% of your primary and secondary claims within three business days of their entering DROP status, or we will credit you 2% of that month's invoice for every 1% we fall below 95%. On rare occasions, claims are exempted from this minimum service commitment.

By signing up with athenahealth, you grant us authority to sign claims and retrieve payment information on your behalf so we can do our part of the co-sourcing arrangement. We also want to make sure you know athenahealth is not paying your claims. We are passing them onto the people (insurance companies, the government, corporations, and patients) who will pay them.

For claims that require an original physician signature, athenahealth will submit those claims whenever possible (on paper, of course) and sign them "athenahealth on behalf of [doctor's name]." Most payers accept that as an original signature, except, for example, New York and Illinois Medicaid. In those cases, we will print the claims and send them to you. You will sign and mail them.

Some payers have custom paper claim forms or requirements for submitting claims that are not supportable by athenahealth. These claims will go into a queue for you to print (or type, or handwrite) and submit. If you need to submit non-CMS-1500 or non-UB-04 paper claims, please provide a sample of the custom forms to your salesperson who will check to see whether that format is supported. You are responsible for submitting claims with unsupported formats. athenahealth does not guarantee that we will support any paper claim formats besides the CMS-1500 and UB-04.

You are responsible for printing and submitting secondary or tertiary insurance claims that require documentation other than proof of prior payment. athenahealth will submit secondaries that require the primary's EOB, but you must submit secondaries that require operating notes, for example.

Institutional, or facility, claims are required in certain cases, such as for Ambulatory Surgery Centers (ASCs), Provider-Based Clinics, and Rural Health Clinics (RHCs). athenahealth sends institutional claims in UB-04 or ANSI 837I format, but we do not bill DRG or APCs or provide DRG/APC pricing functionality. You may be charged a custom development fee if you need to submit institutional claims to an unsupported payer. Primary institutional claims are sent on paper, except to Medicare A, which is electronic. All secondary institutional claims are sent on paper, except secondaries to Medicare A, for which you will enter data directly into the intermediary's Web site.

athenahealth sends claims via paper or through electronic linkages directly with payers or claim intermediaries. athenahealth does not enter claim data or submit batch claims directly into payer Web sites nor do we query these systems for claim status or payment information. If DDE is the only way a payer allows claims to be submitted, entering those claims will be your responsibility.

Because Medicare A uses a DDE system, athenahealth needs your help for at least the first month after your go-live to detect and repair denials. Because we cannot log in to the Medicare system as you, you will need to pass information from the DDE system to our rules team on a daily or weekly basis.

athenahealth does not send claims to payers outside the United States and its territories; however, athenahealth does send patient statements to foreign addresses with an additional charge to cover international postage.

You are responsible for maintaining what, in athenaOne, are called your "fee schedules," that is, the amount you charge for your services.

athenahealth attempts to make sure that the claims we submit get to the payer. If the payer provides electronic acknowledgement that it has received your claims into its adjudication system, we retrieve the acknowledgement and attach it to the claim. If the payer is less sophisticated, we wait between 5 and 60 days (the number depends on the payer) and then call the payer to confirm that the payer is processing the claim if we have not already received a payment.

athenahealth sends invoices directly to corporations, law firms, and other non-health insurance payers. We call this "Corporate Billing," "Contract Billing," or "Legal Billing," depending on the type of payer. athenahealth will post payments from these payers, but does not follow up or research denials or verify overpayments with them. Unpaid or denied corporate claims are your responsibility.

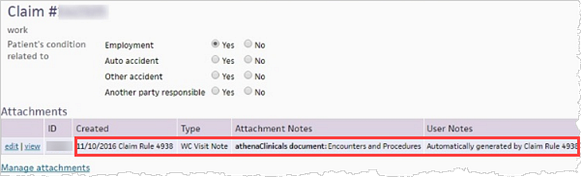

If your practice uses athenaClinicals, athenaOne automatically attaches the visit note to the motor vehicle accident (MVA) or workers compensation accident claim. The encounter associated with the claim must be closed. In the Attachments section of the Claim Edit page, you see Claim Rule/Business Requirement BR-006224 (workers compensation) or Claim Rule/Business Requirement BR-006498 (auto accident).

Note: If a rule has been migrated to the new Billing Rules system (or is a new rule added only in the new Billing Rules system), you'll see a Business Requirement ID (BR-######) instead of a legacy Rule ID.

You can click Manage attachments to attach additional documents to the claim.

If you create the claim before the encounter is closed, athenaOne adds the attachments to the claim after you close the encounter.