User Guide — Billing Follow-Up

User Guide — Billing Follow-Up

The responsibility for following up on billing and claim management tasks is shared, or "co-sourced," between athenahealth and your organization.

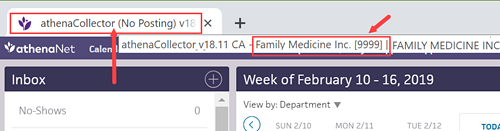

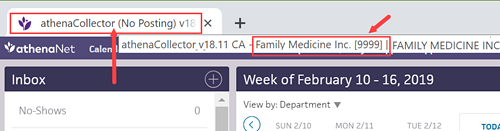

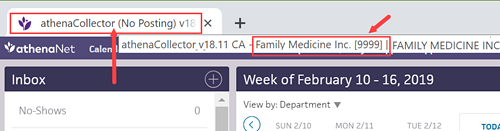

Tip: You can see your athenaCollector service level at the very top of your screen, on the leftmost tab of the Web browser. You can also pause your cursor over the tab to view your practice name and practice ID number.

Your organization enters all charges and creates all claims in athenaOne.

athenahealth submits all claims in DROP status to the appropriate payer. Claim submission means:

- Generate and submit all claims in "primary," "secondary," and "forced drop to paper" categories.

- Generate patient statements.

- Your practice is responsible for follow-up of all claims in HOLD, MGRHOLD, OVERPAID, and MISSING status.

- athenahealth is responsible for claims in DROP, ATHENAHOLD, CBOHOLD, BILLED, and FOLLOWUP status, and for posting remittance information.

Note: You can see your athenaCollector service level at the very top of your screen, on the leftmost tab of the Web browser. You can also pause your cursor over the tab to view your practice name and practice ID number.

- Your practice is responsible for follow-up of all claims in BILLED, HOLD, MGRHOLD, CBOHOLD, MISSING, FOLLOWUP, APPEALED, and OVERPAID status.

- athenahealth is responsible for claims in DROP and ATHENAHOLD status, and for posting remittance information.

Note: You can see your athenaCollector service level at the very top of your screen, on the leftmost tab of the Web browser. You can also pause your cursor over the tab to view your practice name and practice ID number.

- Your practice is responsible for follow-up of all claims in BILLED, HOLD, MGRHOLD, CBOHOLD, MISSING, FOLLOWUP, APPEALED, and OVERPAID status, and for posting remittance information.

- athenahealth is responsible for claims in DROP and ATHENAHOLD status.

Note: You can see your athenaCollector service level at the very top of your screen, on the leftmost tab of the Web browser. You can also pause your cursor over the tab to view your practice name and practice ID number.

If your practice uses the Corporate Billing feature, please note that:

- You are responsible for all follow-up of corporate billing claims.

- Corporate billing claims are dropped only once by athenahealth; additional submissions are your responsibility.

- To resubmit a corporate billing claim, change the claim status from BILLED status to DROP status.

- No claim alarms fire on corporate billing claims.

- The Corporate Billing feature is available to athenaCollector, athenaCollector (No Follow-Up), and athenaCollector (No Posting) clients.

When you're working a claim that has been kicked with WEBACCESSREQUEST, we are requesting your practice to provide Web portal login information so that athenahealth can access payer websites on your behalf. We request this access while we conduct follow-up, obtain claim status, and download remittance.

- Set up an access account on the payer's Web portal for use by athenahealth.

When you set up an access account for athenahealth to use, please use the following information when creating a username and password for the payer website: - First Name: John

- Last Name: Sundar

-

Email: PayersiteXXXX@operations.athenahealth.com (replace XXXX with your context ID/practice ID/tablespace #).

Note: This email is for registration purposes only. Please do not send communications directly to this email address. - Phone: 470-237-1816

- Fax Number: 888-864-4377

- Address: 3 Hatley Rd., Belfast, ME 04915

- Date of Birth: 15/07/1987

- Preferred username: AthenaXXXX (XXXX = your client ID)

-

After you create access for athenahealth, please update the information in the outstanding payer portal task. Include the URL of the Web portal when providing the login credentials, as well as your client ID, tax ID number, and the medical group/individual NPI associated with the credentials.

Important: Please do not enter the login information in claim notes or in a remittance record.

- Sometimes the login information that we are given is incorrect or outdated, or we do not have the correct payer portal Web URL.

- If our teams find the portal to be inaccessible, they will place the claim back into WEBACCESSREQUEST status to inform the practice of the issue.

- Please return the payer portal task with your comments to athenahealth.

- Please do not include any Web portal login information in claim notes.

A claim with WEBACCESSRVW is assigned to athenahealth to work. If no response is received from the payer following a claim submission, or if certain denial messages are received, athenahealth follows up with the payer. If a claim cannot be worked by phone and athenahealth does not have portal access, the claim is kicked with WEBACCESSRVW. We then review and work the claim if we have the necessary access to a payer website.

No practice action is needed on claims in WEBACCESSRVW. If additional access is needed to work the claim, the claim is kicked with WEBACCESSREQUEST and moved to MGRHOLD. You will see a detailed note with the access request and the payer website's URL (see the steps in this section for more information).

athenaCollector service: The athenahealth Posting Team is responsible for posting payments in athenaOne.

athenaCollector (No Follow-Up) service: The athenahealth Posting Team is responsible for posting payments in athenaOne.

athenaCollector (No Posting) service: Your practice is responsible for posting payments in athenaOne.

The athenaCollector service includes claim and remittance tracking. athenahealth commits to performing actions on your claims within 20 business days after the claim enters a FOLLOWUP primary or secondary status.

athenaCollector (No Follow-Up) service: athenahealth submits claims for you, but your practice is responsible for all claim follow-up (athenaOne sets no claim alarms and takes no follow-up actions on your claims).

athenahealth uses claim alarms to determine when to take action on a set of claims. Claim alarms specify a duration of time during which remittance is expected from a payer. After the expected time lapses, athenahealth or your practice must contact the payer to determine the status of the claims. For more information, see Claim Alarms.

Claims enter a FOLLOWUP status when the primary or secondary insurance payer has not sent remittance (EOB/ERA) to be posted to the claim. Typically, claims that enter the FOLLOWUP status are:

- Not on file with the payer

- Still in the adjudication process

- Paid or denied

athenahealth reviews the claim status and downloads remittance (if available) from payer Web portals. athenahealth users also call payer IVR systems or speak with payer representatives to retrieve the needed information.

Depending on the cause of the FOLLOWUP status, athenahealth takes the following actions on these claims.

- Not on file — Claim is resubmitted to the payer in the original manner.

- Claim in process (CIP) — Claim is pended based on information from the payer representative.

- Paid or denied — Claim is pended based on information from the payer representative while we wait for remittance to be received and posted.

Throughout the claim tracking process, like situations are analyzed for corrective actions so that future claims are not routed to FOLLOWUP status due to lack of response from a payer.

When a claim enters FOLLOWUP status, no action is required on your part. For recurring situations, you can send us a request or message using the claim note. If athenahealth needs you to take an action, we redirect the claim to HOLD or MGRHOLD status, based on the type of assistance needed.

Note: To address claims that enter a FOLLOWUP status, athenahealth will ask you to supply us with the appropriate Web portal credentials (see "Web access").

The athenaCollector service includes denial research, appeal, and corrected claim handling. athenahealth commits to performing actions on your claims within 10 business days after a claim enters a CBOHOLD primary or secondary status.

athenaCollector (No Follow-Up) service: athenahealth submits claims for you, but you are responsible for all denial research, appeals, and claim resubmissions.

Claims enter a CBOHOLD status when the primary or secondary insurance payer has sent an explanation of benefits (EOB) or electronic remittance advice (ERA) with a denial response. Claims that enter the denials workflow have received specific or non-specific denial remark codes from the payer. The claims may also be paid at $0.00 or have an adjustment.

Denied claims can be corrected or appealed and then sent back to the payer.

Depending on the cause of the denial, athenahealth takes the following actions on these claims.

- Specific remark codes — athenahealth uses all available resources to address or correct the error for which the payer has denied the claim.

- Non-specific remark codes — athenahealth contacts the payer to research the denial and obtain instructions for how to correct the error.

- CPT codes paid at $0.00 — athenahealth reviews the CPT codes with a billed amount greater than $200.00 to determine whether the claim can be appealed.

For more information, see athenahealth Claim Appeal on Your Behalf.

For claims with a billed amount less than $200.00, you are responsible for reviewing CPT codes. If an appeal is necessary, you also need to attach supporting documentation or update any coding issues flagged by the payer.

The athenahealth Rules team actively researches and builds systemic rules (both universal and payer-specific) to create clean claims. The Rules team:

- Builds rules based on claims denied because of formatting issues and reviews existing formatting rules.

- Builds rules based on claims denied because of payer-specific process or procedural changes and reviews existing payer-specific rules.

- Reviews and updates payer-specific kick codes.

athenahealth actively maintains a global list of insurance packages and verifies within five business days the accuracy of insurance data submitted by your practice.

athenahealth reviews certain types of claim denials and resolves the denials when possible. If athenahealth is unable to resolve and resubmit the denied claim, or if the denied codes are not expected to be paid if resubmitted, we return the claim to you with claim note advice.

If your organization uses both athenaCollector and athenaClinicals, athenahealth reviews coding-related back-end denials for claims that have been denied with the following codes.

- AGECPTMATCH

- AGEDXMATCH

- CPT

- CPTCHANGE

- DIAGNOSIS

- DXCPTMATCH

- GENDERCPTMATCH

- GENDERDXMATCH

- MODCPTMATCH

- MODIFIER

- POS

- POSCPTMATCH

If a claim has one of these coding denials and has clinical documentation in the patient chart, athenahealth assigns the claim to CBOHOLD status. After we review the claim, we mark it with one of the following tags:

- **CODING ADVICE** — If a claim needs a coding correction, we add claim note advice and return the claim to you. After you make the necessary changes and apply the DRPBILLING kick code, athenahealth resubmits the claim.

- **ADVICE TO ADJUST** — If a claim is unlikely to be paid due to payer billing requirements, we may add advice for adjustment and return the claim to you.

- **DOCUMENTATION REQUEST** — If a claim has insufficient clinical documentation to support billing, we return the claim to you with a claim note. After you add or update the clinical documentation, we will review it.

If we find that the payer erroneously denied a claim, athenahealth resubmits the claim after reviewing the billing and supporting clinical documentation.

If your organization uses both athenaCollector and athenaClinicals, athenahealth reviews denials related to medical policies and insurance benefits for claims that have been denied with the following codes:

- MEDPOLICY — athenahealth reviews the claim and available medical records to verify insurance package selection.

- NCPREVIEW — athenahealth reviews the claim and available medical records to verify insurance package selection.

- MP — athenahealth reviews the claim and available medical records to verify insurance coverage.

- SERVICEMAX — athenahealth reviews the claim and available medical records to verify insurance coverage.

- NMN — athenahealth reviews the claim and available medical records to verify medical necessity.

When athenahealth reviews these denials, we assign the claim to CBOHOLD status and attempt to resolve and resubmit the claims to the payer. If we are unable to resolve the issue and resubmit the claim, or if the denied codes are not expected to be paid if resubmitted, we return the claim to you with clear coding or adjustment advice or we request additional medical records.

Note: athenahealth is assuming this work gradually, through 2019. When this feature becomes available to your organization, you will receive an athenaNetwork posting.

athenahealth reviews denials with an IPN or NEREVIEW kick code for claims with or without an insurance card on file in athenaOne. These denials indicate that the patient's insurance information is incorrect (IPN kick code) or that the patient's eligibility is in doubt (NEREVIEW kick code).

If a claim has one of these patient insurance denials with no associated insurance card image, we assign the claim to CBOHOLD status and attempt to resolve and resubmit the claim to the payer.

Note: For information about other insurance-related denials, see Eligibility-related denials.

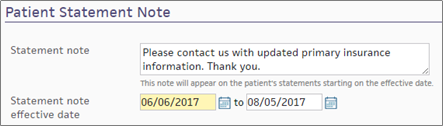

If athenahealth is unable to resolve the issue and resubmit the claim, we send a statement to the patient with a note asking the patient to contact you to provide updated insurance information. (This note appears in the Patient Statement Note section of the Patient Account View page.)

If athenahealth cannot resolve the patient insurance issue and the patient cannot be billed, the claim may be returned to you for review.

Note: athenahealth is assuming this work gradually, through 2019. When this feature becomes available to your organization, you will receive an athenaNetwork posting.

athenahealth automatically reviews claims that have been denied with the following codes:

- INDICATOR — athenahealth makes claim formatting corrections.

- NDCNUMB — athenahealth corrects the National Drug Code (NDC) number based on claim coding and medical records.

- PRACCHGRVW — athenahealth corrects posting issues.

When athenahealth reviews these denials, we assign the claim to CBOHOLD status and attempt to resolve and resubmit the claims to the payer. If we are unable to resolve the issue and resubmit the claim, we return the claim to you with clear instructions for next steps based on our research.

Note: athenahealth is assuming this work gradually, through 2019. When this feature becomes available to your organization, you will receive an athenaNetwork posting.

Beginning in April 2025, we're automating some low dollar amount athenahealth denials management tasks for charges that are unlikely to be paid.

Benefits:

- Automated tasks for faster turnaround time

-

Improved claim note format that is easier to read

- Reduced volume of claims that need resubmission

-

Focused coder intervention only where coding corrections are actually needed

- Reduced manual work for practice staff and athenahealth Denials Management team

Note: This automation only applies to CBOHOLD denials that are reviewed by the athenahealth Denials Management team.

What's automated?

- The athenahealth AI technology reviews the claim.

-

Using advanced machine learning techniques and continuous data analysis, the model identifies charges that are highly unlikely to be paid upon resubmission (based on historical payment trends and payer guidelines).

-

The athenahealth AI technology adds a claim note with details specific to the denied charges.

Will the AI-generated claim notes look different?

-

The claim note added by the athenahealth AI technology will look very similar to the claim note that is manually added by the athenahealth Denials Management team.

-

Both the manually added note and the automatically added note will have:

-

Specific details about the denied charges

-

Action: NOTE

-

Claim Status: MGRHOLD

-

- The User on the claim note will be different:

Manually added claim notes have User: <athenaOne username>

AI-generated claim notes will have User: AI Insight

| athenaOne release date | Type of Denials | Automated claim note/ kick code |

|---|---|---|

| April 2025 | Coding, Medical policy, and Benefit coverage denials |

"Advice to Adjust" / [ADJUST] kick code |

| June 2025 | Unspecified denials – When the payer has not provided a denial code, or when the payer has provided a denial code that does not indicate any helpful or guiding information. The denial requires additional research or payer contact. |

"Advice to Adjust" / [ADJUST] kick code |

| June 2025 | Coding denials that might be resolved with coding-related changes |

"CODING ADVICE" / coding-related kick code |

| October 2025 |

Coding denials with no coding changes needed

|

"Advice to Adjust" / [ADJUST] kick code |

Your practice can continue to use your existing workflow for handling claims on MGRHOLD with "Advice to Adjust" or "CODING ADVICE".

We plan to expand to other types of denials in upcoming releases. The updates will be communicated to you in future release notes.

If your practice uses an insurance card scanner, athenahealth routes claims with certain eligibility-related denials to CBOHOLD instead of HOLD, and we work the claims for you.

Note: athenahealth also reviews IPN and NEREVIEW denials for claims without an insurance card image (see "Automatic review of claim denials" on the Billing Follow-Up page).

athenahealth works claims that are denied with these kick codes: BAC, IPN, BADPKG, NO2NDRY, REGERROR, GRPNMBR, SECINS, NAME, NEREVIEW, MVAPIP, PTADDRESS, DOB, ADDRINSURE, RELATION, DEPEND, NAMEINSURE, and GENDER. athenahealth also works patient insurance denials related to more than 300 claim rules.

A kick code automatically moves these claims to CBOHOLD, saving you time and effort. This kick code, HOLDSTATUSRVW, includes a claim note explaining the move from HOLD to CBOHOLD.

athenahealth examines a scanned insurance card image to make sure that the correct insurance package is selected and that the correct member ID information is included. We may also check a patient's insurance history, including EOBs for past claims. If we find that the claim was denied improperly or if we can update the insurance information, we perform an eligibility check and resubmit the claim immediately.

We send a patient statement (kick the claim using PTRESP) and include a request to the patient to supply insurance information to process the claim. The note includes as much detail as we can supply. For example, we may specify that the patient was not eligible on the date of service, or that the patient appears not to be covered. If there is no valid insurance information, the patient can use this statement to submit payment.

athenahealth handles claim rules and denials associated with patient insurance. When one of these rules or kick codes is applied to a claim, a posting rule fires immediately, redirecting the claim to athenahealth using the HOLDSTATUSRVW:CBORVW action. No further action is required from you at this time.

athenahealth assumes responsibility for claims related to patient insurance issues. These issues can be classified as follows.

Kick codes such as BAC and REGERROR, along with over 50 rules, make up the coordination of benefits work for which athenahealth assumes responsibility. These rules and kick codes indicate that the patient's insurance policies were billed in the wrong order.

Kick codes such as NAME and PTADDRESS, along with over 75 rules, indicate a problem with the patient's demographic information. These rules and kick codes are triggered by a discrepancy between the information that you and the payer have on file or by information that was identified as invalid, such as an incorrect ZIP code. This work can be routed to athenahealth from an insurance denial or from a user action.

Kick codes such as IPN and GRPNMBR, along with over 50 rules, make up the member information work for which athenahealth assumes responsibility. These kick codes and rules indicate that the member information entered for the patient, such as the member ID or group number, is invalid or missing.

Kick codes such as BADPKG, along with over 75 rules, make up the insurance package work for which athenahealth assumes responsibility. This type of work indicates that the package selected for the patient is incorrect.

Kick codes such as NEREVIEW and rule 351 make up the eligibility work for which athenahealth assumes responsibility.

- Rule 351 fires when the payer returns an ineligible response to an athenaOne eligibility check.

- The NEREVIEW kick code is returned if the payer cannot locate the patient in their files.

Note: Rule 351 routes claims to CBOHOLD only if an insurance card image is present.

For more information, see "Insurance eligibility denials."

In some cases, athenahealth needs an image of the patient's insurance card to resolve the claim rule or denial kick code on a patient insurance claim. If no insurance card image is available when one of these kick codes or rules fires on a claim, the claim is routed to your HOLD queue.

athenahealth uses a number of information sources to resolve patient insurance rules and kick codes.

Reviewing a current insurance card image is one of the easiest ways for athenahealth to resolve a patient insurance-related issue. Because the card image displays the payer, product type, and claim submission address, it can help verify member ID and group number formatting, product type, and package selection.

Payer eligibility details are one of the main tools used to resolve a patient insurance-related issue, especially when no card image is available. Eligibility details can be used to:

- Locate other payer information for a coordination of benefits issue.

- Verify the insurance package selection.

- Identify a demographic issue for the insurance policy holder.

A patient's billed claim history can help determine which insurance information has previously resulted in payment or denial for the patient. A billed claim history can also be helpful in identifying payer processing errors.

A patient's family claim history can be helpful in finding active coverage, especially when the patient is a child of dependent age.

athenahealth uses payer portals when available to:

- Locate up-to-date coordination of benefits information, member IDs, and group numbers.

- Guide the selection of the correct insurance package for the patient.

Payer portals and billing guidelines can also help us determine non-covered or carve-out services.

Most patient insurance work handled by athenahealth does not require a phone call. As a last resort, athenahealth places a phone call when all eligibility information available in athenaOne indicates that the patient is eligible, but we received the eligibility related denial kick code NEREVIEW. In this case, we may phone the payer about the claim to determine why the patient cannot be found if we have a valid eligibility check on file.

If athenahealth cannot resolve a patient insurance issue and bill the claim, we send a patient statement that includes a note asking the patient to contact the practice with updated insurance information. The purpose of this statement is to encourage the patient to contact you with updated information, so that the claim can be billed to the correct insurer. To see the note entered by athenahealth, display the Patient Account View page and scroll down to the Patient Statement Note heading.

The best way to reduce the number of claims in your HOLD and MGRHOLD queues for patient insurance-related rules or kick codes is to capture an image of the patient's insurance card whenever possible.

Note: If no insurance card image is available when certain kick codes or rules fire on a claim (for example, rule 351), the claim is routed to your HOLD queue.

Other patient insurance work may be routed to your worklists if athenahealth cannot find the information needed to bill the correct insurance and is unable to send a statement to the patient. Typically, when a claim in your HOLD or MGRHOLD queue requires patient insurance work, you need to contact the patient.