User Guide — Relative Value Units (RVUs)

User Guide — Relative Value Units (RVUs)

Each CPT or HCPCS code used in your practice is assigned a weighted value called an RVU. This numerical value is assigned to a CPT code based on its difficulty and resource consumption. Each RVU is separated into three distinct categories: physician work, practice expense, and malpractice expense.

The CMS Glossary defines RVU as follows:

"Relative Value Unit (RVU): Basic element of measure for the Medicare Resource-Based Relative Value Scale (RBRVS). Each service is assigned relative value units for physician work, practice expenses and professional liability insurance. The three added together are the relative value of the service. RVUs are modified by geographic practice cost index values to compensate for regional variations in practice costs."

Note: You can access the CMS Glossary from the Code and Knowledge Base (On the Main Menu, click Claims. Under RESOURCES, click Code and Knowledge Base).

Relative value units — RVUs — were created by CMS to display the relative intensity of resources required to care for a range of diseases and conditions (CPT codes). These resources are:

- Physician work (52%) — Amount of time and effort put into a certain procedure

- Practice expense (44%) — Cost of equipment and supplies

- Malpractice expense (4%) — Estimate based on the risk per specialty

Each RVU component value is adjusted by geographic region; for example, a procedure performed in Manhattan is worth more than a procedure performed in El Paso.

The GPCI (Geographic Practice Cost Index) is determined by the ZIP code of the department. For example, in 2005, a generic 99213 code was worth 1.39 RVUs. Adjusted for Northern New Jersey, it was worth 1.57 RVUs. Using the 2005 conversion factor of $37.90, Medicare paid 1.57 × $37.90 for each 99213 performed, or $59.50.

Practice expense RVU components address the costs of maintaining a practice, including items such as rent, equipment, supplies, and non-physician staff costs. The practice expense RVU is calculated using a bottom-up methodology, where the direct costs of providing a service are calculated, and the indirect costs are allocated.

- Direct costs include costs that can be assigned to a specific service; a direct cost would be the actual supplies, equipment, and staff time used for a given CPT code.

- Indirect costs include costs that cannot be directly attributed to the provision of a service, such as having a waiting room or a billing service.

Frequently, a CPT code is assigned one practice expense RVU for a facility setting — such as a hospital — and a different practice expense RVU for a non-facility setting, such as a freestanding center. For example, freestanding radiation oncology centers receive more practice expense compensation than hospital-based centers, because the practice expense of owning and operating equipment and providing staff resources is significantly greater than the practice expenses covered by the physician in a hospital setting.

Note: The hospital is paid under the Hospital Outpatient Prospective Payment System (HOPPS or OPPS) for the radiation oncology equipment and services. Hospital-based physicians are paid under the Medicare Physician Fee Schedule (MPFS) in the same manner as freestanding-based physicians.

RVUs are created and maintained by CMS. Modifications to RVUs appear in the annual revisions of the various national fee schedules, including the Medicare Physician Fee Schedule. The total RVU and the individual category values are shown next to each CPT code listed in the Medicare Physician Fee Schedule sent to your practice each year.

You can run reports on RVU components using the Activity Wizard and the Transaction Activity reports in the Report Builder. If you configured custom RVU values for procedure codes or modifiers, you can run the RVU Report in the Report Library to display a list of transactions with their customized RVU values.

You can use the Activity Wizard and the Transaction Activity reports in the Report Builder to report on RVU components.

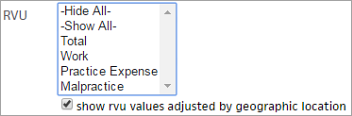

The RVU filter in the Activity Wizard allows you to show each component of the Total RVU (Work, Practice Expense, and Malpractice), as well as the Total RVU. Each RVU component value is adjusted using the corresponding GPCI (Geographic Practice Cost Index) multiplier for that component. The show rvu values adjusted by geographic location option is selected by default.

The following RVU values are available in the Activity Wizard and in the Transaction Activity reports that you can run using the Report Builder:

- Total RVU

- Adjusted Total RVU

- Work RVU

- Adjusted Work RVU

- Malpractice RVU

- Adjusted Malpractice RVU

- Practice Expense RVU

- Adjusted Practice Expense RVU

Note: To see relationships between custom, non-standard relative value units (RVUs) and existing procedure codes and report on these combinations, run the RVU Report (on the Other tab of the Report Library).

The values for procedure codes returned by the Activity Wizard and the Transaction Activity reports in the Report Builder are taken from the CMS Glossary of RVU values. These values are uploaded to athenaOne on a regular basis from third-party vendor nThrive.

Note: You can access the CMS Glossary from the Code and Knowledge Base (On the Main Menu, click Claims. Under RESOURCES, click Code and Knowledge Base).

Calculation of non-adjusted RVU values

If you select the non-adjusted RVU components in the Activity Wizard or the Transaction Activity reports in the Report Builder (Work RVU, Malpractice RVU, Practice Expense RVU, and Total RVU), the report calculates the values as follows:

- Compare the service date CPT code (including modifiers) to the procedure codes in the CMS Glossary.

- Multiply the RVU values for that procedure code (or procedure code + modifier combination) by the number of charges billed.

Calculation of adjusted RVU values

If you select the adjusted RVU components in the Activity Wizard or the Transaction Activity reports in the Report Builder (Adjusted Work RVU, Adjusted Malpractice RVU, Adjusted Practice Expense RVU, and Adjusted Total RVU), the report calculates the values as follows:

- Compare the service date CPT code (including modifiers) and the geographic location of the service department to the adjusted procedure codes in the CMS Glossary.

- Multiply the adjusted RVU values for that procedure code (or procedure code + modifier combination) by the number of charges billed.

You can run the RVU Report (on the Other tab of the Report Library) to see relationships between custom, non-standard relative value units (RVUs) and existing procedure codes and report on these combinations. To access the RVU Report, you must be able to view reports in the Report Library.