Claim Review Tab

athenaOne for Hospitals & Health Systems

This is the last tab in the Checkout stage of the 5-stage patient encounter. This tab allows you to view the status and summary of a single claim after submission.

If the claim is not in DROP status, you can click edit claim or the Return to Claim:Billing link (athenaClinicals) if you need to make changes. This page also provides a link to manage attachments.

You may need to consult with the patient to resolve claim errors. While the patient is still in the office, correct any problems with the claim needed to achieve DROP status for the claim.

After you achieve DROP status for the claim and complete all Checkout stage tasks, click Done with Checkout. This action updates the appointment status to 4 because the claim has been created and the patient is checked out.

This concludes the 5-stage patient encounter.

Your organization enters all charges and creates all claims in athenaOne.

athenahealth submits all claims in DROP status to the appropriate payer. Claim submission means:

- Generate and submit all claims in "primary," "secondary," and "forced drop to paper" categories.

- Generate patient statements.

- Your practice is responsible for follow-up of all claims in HOLD, MGRHOLD, OVERPAID, and MISSING status.

- athenahealth is responsible for claims in DROP, ATHENAHOLD, CBOHOLD, BILLED, and FOLLOWUP status, and for posting remittance information.

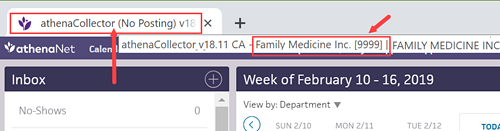

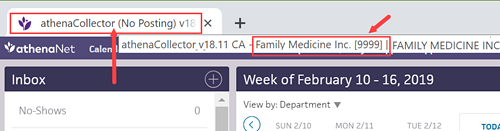

Note: You can see your athenaCollector service level at the very top of your screen, on the leftmost tab of the Web browser. You can also pause your cursor over the tab to view your practice name and practice ID number.

- Your practice is responsible for follow-up of all claims in BILLED, HOLD, MGRHOLD, CBOHOLD, MISSING, FOLLOWUP, APPEALED, and OVERPAID status.

- athenahealth is responsible for claims in DROP and ATHENAHOLD status, and for posting remittance information.

Note: You can see your athenaCollector service level at the very top of your screen, on the leftmost tab of the Web browser. You can also pause your cursor over the tab to view your practice name and practice ID number.

- Your practice is responsible for follow-up of all claims in BILLED, HOLD, MGRHOLD, CBOHOLD, MISSING, FOLLOWUP, APPEALED, and OVERPAID status, and for posting remittance information.

- athenahealth is responsible for claims in DROP and ATHENAHOLD status.

Note: You can see your athenaCollector service level at the very top of your screen, on the leftmost tab of the Web browser. You can also pause your cursor over the tab to view your practice name and practice ID number.

If your practice uses the Corporate Billing feature, please note that:

- You are responsible for all follow-up of corporate billing claims.

- Corporate billing claims are dropped only once by athenahealth; additional submissions are your responsibility.

- To resubmit a corporate billing claim, change the claim status from BILLED status to DROP status.

- No claim alarms fire on corporate billing claims.

- The Corporate Billing feature is available to athenaCollector, athenaCollector (No Follow-Up), and athenaCollector (No Posting) clients.

When you're working a claim that has been kicked with WEBACCESSREQUEST, we are requesting your practice to provide Web portal login information so that athenahealth can access payer websites on your behalf. We request this access while we conduct follow-up, obtain claim status, and download remittance.

- Set up an access account on the payer's Web portal for use by athenahealth.

When you set up an access account for athenahealth to use, please use the following information when creating a username and password for the payer website: - First Name: John

- Last Name: Sundar

-

Email: PayersiteXXXX@operations.athenahealth.com (replace XXXX with your context ID/practice ID/tablespace #).

Note: This email is for registration purposes only. Please do not send communications directly to this email address. - Phone: 470-237-1816

- Fax Number: 888-864-4377

- Address: 3 Hatley Rd., Belfast, ME 04915

- Date of Birth: 15/07/1987

- Preferred username: AthenaXXXX (XXXX = your client ID)

-

After you create access for athenahealth, please update the information in the outstanding payer portal task. Include the URL of the Web portal when providing the login credentials, as well as your client ID, tax ID number, and the medical group/individual NPI associated with the credentials.

Important: Please do not enter the login information in claim notes or in a remittance record.

- Sometimes the login information that we are given is incorrect or outdated, or we do not have the correct payer portal Web URL.

- If our teams find the portal to be inaccessible, they will place the claim back into WEBACCESSREQUEST status to inform the practice of the issue.

- Please return the payer portal task with your comments to athenahealth.

- Please do not include any Web portal login information in claim notes.

A claim with WEBACCESSRVW is assigned to athenahealth to work. If no response is received from the payer following a claim submission, or if certain denial messages are received, athenahealth follows up with the payer. If a claim cannot be worked by phone and athenahealth does not have portal access, the claim is kicked with WEBACCESSRVW. We then review and work the claim if we have the necessary access to a payer website.

No practice action is needed on claims in WEBACCESSRVW. If additional access is needed to work the claim, the claim is kicked with WEBACCESSREQUEST and moved to MGRHOLD. You will see a detailed note with the access request and the payer website's URL (see the steps in this section for more information).

athenaCollector service: The athenahealth Posting Team is responsible for posting payments in athenaOne.

athenaCollector (No Follow-Up) service: The athenahealth Posting Team is responsible for posting payments in athenaOne.

athenaCollector (No Posting) service: Your practice is responsible for posting payments in athenaOne.

The athenaCollector service includes claim and remittance tracking. athenahealth commits to performing actions on your claims within 20 business days after the claim enters a FOLLOWUP primary or secondary status.

athenaCollector (No Follow-Up) service: athenahealth submits claims for you, but your practice is responsible for all claim follow-up (athenaOne sets no claim alarms and takes no follow-up actions on your claims).

athenahealth uses claim alarms to determine when to take action on a set of claims. Claim alarms specify a duration of time during which remittance is expected from a payer. After the expected time lapses, athenahealth or your practice must contact the payer to determine the status of the claims. For more information, see Claim Alarms.

Claims enter a FOLLOWUP status when the primary or secondary insurance payer has not sent remittance (EOB/ERA) to be posted to the claim. Typically, claims that enter the FOLLOWUP status are:

- Not on file with the payer

- Still in the adjudication process

- Paid or denied

athenahealth reviews the claim status and downloads remittance (if available) from payer Web portals. athenahealth users also call payer IVR systems or speak with payer representatives to retrieve the needed information.

Depending on the cause of the FOLLOWUP status, athenahealth takes the following actions on these claims.

- Not on file — Claim is resubmitted to the payer in the original manner.

- Claim in process (CIP) — Claim is pended based on information from the payer representative.

- Paid or denied — Claim is pended based on information from the payer representative while we wait for remittance to be received and posted.

Throughout the claim tracking process, like situations are analyzed for corrective actions so that future claims are not routed to FOLLOWUP status due to lack of response from a payer.

When a claim enters FOLLOWUP status, no action is required on your part. For recurring situations, you can send us a request or message using the claim note. If athenahealth needs you to take an action, we redirect the claim to HOLD or MGRHOLD status, based on the type of assistance needed.

Note: To address claims that enter a FOLLOWUP status, athenahealth will ask you to supply us with the appropriate Web portal credentials (see "Web access").

The athenaCollector service includes denial research, appeal, and corrected claim handling. athenahealth commits to performing actions on your claims within 10 business days after a claim enters a CBOHOLD primary or secondary status.

athenaCollector (No Follow-Up) service: athenahealth submits claims for you, but you are responsible for all denial research, appeals, and claim resubmissions.

Claims enter a CBOHOLD status when the primary or secondary insurance payer has sent an explanation of benefits (EOB) or electronic remittance advice (ERA) with a denial response. Claims that enter the denials workflow have received specific or non-specific denial remark codes from the payer. The claims may also be paid at $0.00 or have an adjustment.

Denied claims can be corrected or appealed and then sent back to the payer.

Depending on the cause of the denial, athenahealth takes the following actions on these claims.

- Specific remark codes — athenahealth uses all available resources to address or correct the error for which the payer has denied the claim.

- Non-specific remark codes — athenahealth contacts the payer to research the denial and obtain instructions for how to correct the error.

- CPT codes paid at $0.00 — athenahealth reviews the CPT codes with a billed amount greater than $200.00 to determine whether the claim can be appealed.

For more information, see athenahealth Claim Appeal on Your Behalf.

For claims with a billed amount less than $200.00, you are responsible for reviewing CPT codes. If an appeal is necessary, you also need to attach supporting documentation or update any coding issues flagged by the payer.

The athenahealth Rules team actively researches and builds systemic rules (both universal and payer-specific) to create clean claims. The Rules team:

- Builds rules based on claims denied because of formatting issues and reviews existing formatting rules.

- Builds rules based on claims denied because of payer-specific process or procedural changes and reviews existing payer-specific rules.

- Reviews and updates payer-specific kick codes.

athenahealth actively maintains a global list of insurance packages and verifies within five business days the accuracy of insurance data submitted by your practice.

athenahealth reviews certain types of claim denials and resolves the denials when possible. If athenahealth is unable to resolve and resubmit the denied claim, or if the denied codes are not expected to be paid if resubmitted, we return the claim to you with claim note advice.

If your organization uses both athenaCollector and athenaClinicals, athenahealth reviews coding-related back-end denials for claims that have been denied with the following codes.

- AGECPTMATCH

- AGEDXMATCH

- CPT

- CPTCHANGE

- DIAGNOSIS

- DXCPTMATCH

- GENDERCPTMATCH

- GENDERDXMATCH

- MODCPTMATCH

- MODIFIER

- POS

- POSCPTMATCH

If a claim has one of these coding denials and has clinical documentation in the patient chart, athenahealth assigns the claim to CBOHOLD status. After we review the claim, we mark it with one of the following tags:

- **CODING ADVICE** — If a claim needs a coding correction, we add claim note advice and return the claim to you. After you make the necessary changes and apply the DRPBILLING kick code, athenahealth resubmits the claim.

- **ADVICE TO ADJUST** — If a claim is unlikely to be paid due to payer billing requirements, we may add advice for adjustment and return the claim to you.

- **DOCUMENTATION REQUEST** — If a claim has insufficient clinical documentation to support billing, we return the claim to you with a claim note. After you add or update the clinical documentation, we will review it.

If we find that the payer erroneously denied a claim, athenahealth resubmits the claim after reviewing the billing and supporting clinical documentation.

If your organization uses both athenaCollector and athenaClinicals, athenahealth reviews denials related to medical policies and insurance benefits for claims that have been denied with the following codes:

- MEDPOLICY — athenahealth reviews the claim and available medical records to verify insurance package selection.

- NCPREVIEW — athenahealth reviews the claim and available medical records to verify insurance package selection.

- MP — athenahealth reviews the claim and available medical records to verify insurance coverage.

- SERVICEMAX — athenahealth reviews the claim and available medical records to verify insurance coverage.

- NMN — athenahealth reviews the claim and available medical records to verify medical necessity.

When athenahealth reviews these denials, we assign the claim to CBOHOLD status and attempt to resolve and resubmit the claims to the payer. If we are unable to resolve the issue and resubmit the claim, or if the denied codes are not expected to be paid if resubmitted, we return the claim to you with clear coding or adjustment advice or we request additional medical records.

Note: athenahealth is assuming this work gradually, through 2019. When this feature becomes available to your organization, you will receive an athenaNetwork posting.

athenahealth reviews denials with an IPN or NEREVIEW kick code for claims with or without an insurance card on file in athenaOne. These denials indicate that the patient's insurance information is incorrect (IPN kick code) or that the patient's eligibility is in doubt (NEREVIEW kick code).

If a claim has one of these patient insurance denials with no associated insurance card image, we assign the claim to CBOHOLD status and attempt to resolve and resubmit the claim to the payer.

Note: For information about other insurance-related denials, see Eligibility-related denials.

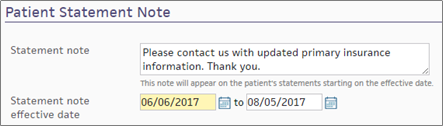

If athenahealth is unable to resolve the issue and resubmit the claim, we send a statement to the patient with a note asking the patient to contact you to provide updated insurance information. (This note appears in the Patient Statement Note section of the Patient Account View page.)

If athenahealth cannot resolve the patient insurance issue and the patient cannot be billed, the claim may be returned to you for review.

Note: athenahealth is assuming this work gradually, through 2019. When this feature becomes available to your organization, you will receive an athenaNetwork posting.

athenahealth automatically reviews claims that have been denied with the following codes:

- INDICATOR — athenahealth makes claim formatting corrections.

- NDCNUMB — athenahealth corrects the National Drug Code (NDC) number based on claim coding and medical records.

- PRACCHGRVW — athenahealth corrects posting issues.

When athenahealth reviews these denials, we assign the claim to CBOHOLD status and attempt to resolve and resubmit the claims to the payer. If we are unable to resolve the issue and resubmit the claim, we return the claim to you with clear instructions for next steps based on our research.

Note: athenahealth is assuming this work gradually, through 2019. When this feature becomes available to your organization, you will receive an athenaNetwork posting.

Beginning in April 2025, we're automating some low dollar amount athenahealth denials management tasks for charges that are unlikely to be paid.

Benefits:

- Automated tasks for faster turnaround time

-

Improved claim note format that is easier to read

- Reduced volume of claims that need resubmission

-

Focused coder intervention only where coding corrections are actually needed

- Reduced manual work for practice staff and athenahealth Denials Management team

Note: This automation only applies to CBOHOLD denials that are reviewed by the athenahealth Denials Management team.

What's automated?

- The athenahealth AI technology reviews the claim.

-

Using advanced machine learning techniques and continuous data analysis, the model identifies charges that are highly unlikely to be paid upon resubmission (based on historical payment trends and payer guidelines).

-

The athenahealth AI technology adds a claim note with details specific to the denied charges.

Will the AI-generated claim notes look different?

-

The claim note added by the athenahealth AI technology will look very similar to the claim note that is manually added by the athenahealth Denials Management team.

-

Both the manually added note and the automatically added note will have:

-

Specific details about the denied charges

-

Action: NOTE

-

Claim Status: MGRHOLD

-

- The User on the claim note will be different:

Manually added claim notes have User: <athenaOne username>

AI-generated claim notes will have User: AI Insight

| athenaOne release date | Type of Denials | Automated claim note/ kick code |

|---|---|---|

| April 2025 | Coding, Medical policy, and Benefit coverage denials |

"Advice to Adjust" / [ADJUST] kick code |

| June 2025 | Unspecified denials – When the payer has not provided a denial code, or when the payer has provided a denial code that does not indicate any helpful or guiding information. The denial requires additional research or payer contact. |

"Advice to Adjust" / [ADJUST] kick code |

| June 2025 | Coding denials that might be resolved with coding-related changes |

"CODING ADVICE" / coding-related kick code |

| October 2025 |

Coding denials with no coding changes needed

|

"Advice to Adjust" / [ADJUST] kick code |

Your practice can continue to use your existing workflow for handling claims on MGRHOLD with "Advice to Adjust" or "CODING ADVICE".

We plan to expand to other types of denials in upcoming releases. The updates will be communicated to you in future release notes.

| Column Headings (under the show voided transactions & full audit History link) |

|

|---|---|

| From |

The date this service began. |

| To |

The date this service was completed. |

| POS |

The place of service (automatically determined from the facility). |

| CPT |

The procedure code. |

| D1 |

Which of the four diagnosis codes is the primary diagnosis for this service. |

| D2 |

Which of the four diagnosis codes is the secondary diagnosis for this service. |

| D3 |

Which of the four diagnosis codes is the tertiary diagnosis for this service |

| D4 |

Which of the four diagnosis codes is the quaternary diagnosis for this service |

| $/unit |

Per-unit charge for this charge line-item. |

| U |

Number of units. |

| NDC Number |

Used for recording National Drug Code numbers. Prints in the shaded area over the charge line for the particular line note. 'N4' qualifier is appended automatically to the NDC number. |

| FP |

Family Planning code; used for some Medicaid programs. |

| EPSDT |

Indicates that this line item is for Early and Periodic Screening, Diagnostic, and Treatment (EPSDT). |

| EMG |

EMG indicator. CMS-1500 Block 24I. |

| C |

COB indicator. CMS-1500 Block 24J. |

| Line note |

To enter a line note that prints in the CMS-1500 shaded area over the charge line for the particular line note, click edit (upper right corner of the charge line) and then click Add next to Line note. This note should contain information that would pertain to a single charge on the claim (for example, notes for an unlisted procedure code). |

| Column Headings for Charge History | |

| type |

The type of transaction displayed (charge, payment, adjustment, transfer out, transfer in).

Note: If the EOB (claim) link appears in this field, clicking it will allow you to view and print the associated Athena Replicated EOB (AREP) and Medicare Replicated EOB (MREP). |

| reason/method |

The type of adjustment, the transfer reason, or the current kick reason.

|

| created |

The date the transaction was created and the username of the person who created the claim. |

| last modified/voided |

The date this transaction was last modified or voided. |

| Ins1 |

Primary insurance amount of responsibility or transaction amount. |

| Ins2 |

Secondary insurance amount of responsibility or transaction amount. |

| patient |

Patient amount of responsibility or transaction amount. |

| Column headings for Claim Notes | |

|---|---|

| Date |

The date the action occurred. |

| User |

The username of the person who took the action. AUTO indicates an automated system function. Usernames that belong to your practice appear in regular font, but athenahealth usernames are italicized. Perot users have the prefix "vhs" in front of their usernames. |

| Action |

The action taken on the claim. Highlighting indicates a system-generated action.

|

| Claim Status |

The status of the claim following this action. |

| Kick/Scrub/Note |

A brief note describing the action, generally including a kick reason. Notes that appear here also appear under the Claim Notes section of the Claim Review, , View Claims for Charge Entry Batch, and the View Claim History pages.

For older claim notes, click [expand text] to see the text as it appeared when the rule fired on the claim.

Claim rules:

The following types of claim notes are the result of claim rules. Note: To override a review claim note, you must have the Claim Note Override: Review role or permission. To override an advice claim note, you must have the Claim Note Override: Advice role or permission.

Note: An override link may also appear when a "predictive rule" fires. A predictive rule is a type of claim advice that uses historical data in athenaOne to predict likely denials, so that you can adjust them off to zero before they appear in your denial work queues. Predictive rules cover Medical Necessity Denials and Benefits Coverage (charges expected to be denied for a benefit limitation or exclusion).

Kick codes:

Each payer has its own denial codes. athenaOne associates different payer denial codes to the athenahealth standard set of kick codes, which determines the appropriate next steps.

Note: When you add a claim note that sets a claim alarm, athenaOne displays the date of the alarm beneath the text of the claim note. The date appears as long as the claim alarm remains active. Claim alarms are reset every time a claim note puts a claim in — or LEAVES a claim in — BILLED status. When claim acknowledgment applies an EMCRCVD or PAYORRCVD claim note, the original alarm is cleared and a new one is set.

Claim Status Inquiry transactions:

Note: CSI transactions are supported for athenaCollector clients only. For more information about CSI, please refer to Claim Status Inquiry. |

| Patient |

The name and patient ID number of the patient on the claim (last name, first name, ID#). |

|---|---|

| Primary Insurance |

The name of the primary insurance plan, the plan address and phone number, the subscriber number, and the first name of the insured. |

| Secondary Insurance |

The name of the secondary insurance plan, the plan address and phone number, the subscriber number, and the first name of the insured (Appears only if applicable). |

| Supervising / Rendering Provider |

The name of the supervising provider / name of the provider who actually rendered the service to the patient. |

| Facility |

The name of the facility (department of service) where the service was provided. |

| Diagnoses |

(These are numbered up to 4; other) 1: The primary diagnosis code and short description; 2: The secondary diagnosis code and short description (blank if there is no secondary diagnosis; 3: 4: other:) |

| Charges | |

| post |

The post date of the charges. |

| from |

The "from" service date of the charges. |

| to |

The "to" service dates of the charges. |

| proc |

The procedure code. |

| u |

Number of units. |

| description |

The procedure code description. |

| pl |

The place of service type code for the service department. Corresponds to CMS-1500 24B. |

| ty |

The type of service of the charge. This may vary depending on the insurance; athenaOne determines from the procedure code on an insurance-specific basis. |

| chg |

The charge amount for this service. |

| Collect Payment | |

| Post Date |

The post date of the charges. |

| Time-Of-Service Batch |

Time-of-service batch used to collect the patient payment. |

| Method |

The payment method used to make the patient payment. |

| Check/CC Number |

The check or credit card number used to make the patient payment (if applicable). |

| (Column headings for any outstanding charges) | |

| Service Date |

The date of service. |

| Procedure |

The procedure code and description. |

| Outstanding Amount |

The amount owed by the patient for this service For self-pay patients, you can use the Check Fee Schedule page (Main Menu → patient → Check Fee Schedule) as a quick reference tool to look up fees for procedure codes. |

| Today's Payment |

The amount that the patient paid for this item today. |

|

|

|

| Today's Copay (expected) |

The type of service rendered for this claim. |

| copay $ |

The expected copay for the type of service (above). |

| $ |

The amount that the patient paid for this item today. |

| Coinsurance (usual coinsurance) |

The coinsurance percentage required by the patient's insurance policy. Coinsurance is an alternative to copay. Use either copay $ or Coinsurance, but not both.

Coinsurance is calculated using the allowable amount from the allowable schedule for the payer and procedure code. If there is no allowable schedule for the payer and procedure code, athenaOne uses the procedure code amount as specified in the fee schedule.

For example, for a $100 charge with a 20% coinsurance, where the payer allowable schedule specifies $80 as the allowable amount, the expected coinsurance is calculated as 20% of $80, or $16. If there were no allowable schedule, the coinsurance amount is calculated as 20% of $100, or $20. |

| Other Payment Amount reason: |

The reason for an additional payment (if the patient makes an additional payment). |

| $ |

The amount of any additional payment (if the patient makes an additional payment). |

| TOTAL $ |

The total amount of patient payments made today. athenaOne auto-populates this field. |