User Guide — Prepayment Plans

User Guide — Prepayment Plans

When you know in advance that a patient will be held responsible for payment for a future service (for example, because of self-pay or a high-deductible policy, or for non-covered or partially covered services), you can use a prepayment plan to collect advance payments and ensure that the money is reserved for the planned procedures.

When you create a prepayment plan, you specify the total amount to be collected, the final due date, and a payment schedule, as well as the expected provider, department, procedure code, and date of service. After you establish a prepayment plan, you can collect, track, transfer, and apply funds toward the specified charges when they are incurred. You can also update or deactivate the prepayment plan as necessary.

- A prepayment plan has a specific purpose: to help a patient set aside the money needed for the cost of a planned service. The funds that the patient contributes under the prepayment plan are intended for the specified service.

- In contrast, the patient's unapplied balance can be automatically applied to any outstanding charge that is designated as the patient's responsibility.

Tip: You can use the Post Prepayment page to transfer money from a prepayment plan to unapplied.

From the perspective of the practice, neither approach is necessarily better than the other: Both prepayment plans and unapplied accounts achieve the goal of collecting money from the patient up front. However, the perspective of the patient may be different.

Example patient 1

A patient wants to set money aside for a specific service six months from now, but prefers to pay for any unplanned issues between now and then as they arise. In this case, a prepayment plan would be more helpful to the patient than an unapplied account. The prepayment plan would allow the patient more control over his money, and would offer peace of mind that all the money he will need for the planned service six months from now will be set aside when the time comes.

Example patient 2

Another patient wants to set money aside for a specific service three months from now, and also wants to set aside a pool of money for any unplanned services. In this case, you could set up a prepayment plan for the specific services and collect prepayments, which increase the prepayment balance toward the specific services. You could also collect payments for unspecified future services, which are applied to the patient's unapplied balance. Keeping the specific and generic funds separate allows you and the patient greater visibility into and control over the funds and how those funds are applied.

Transferring money between a prepayment plan and the unapplied balance

If a patient has both a prepayment plan and an unapplied account, you can transfer funds between the two using one of these pages.

- Post Prepayment — Use this page to transfer unused money from a prepayment plan to the unapplied account.

- Update Prepayment Plan — Use this page to transfer unused money from a prepayment plan to the unapplied account or to transfer money from the unapplied account to a prepayment plan for the patient.

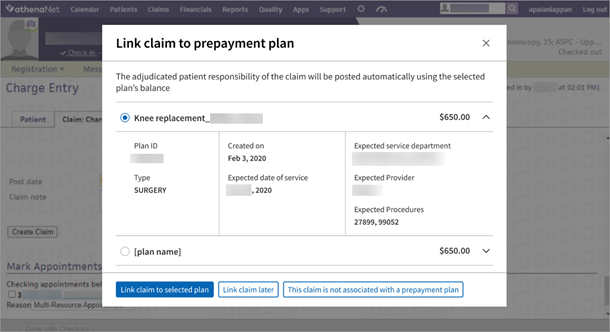

- On the Claim: Charge Entry tab: When you click Create Claim to submit the claim, if the patient has prepayment plans, the new prepayment posting popup window appears.

- Select the plan whose balance you want to apply to this claim. The adjudicated patient responsibility of the claim will be posted automatically using the selected plan balance. Click Link claim to selected plan.

- Alternatively, click one of the other options:

- Link claim later

- This claim is not associated with a prepayment plan

- The Claim Preview page appears with a snapshot view of claim information while the athenaOne system creates the claim and runs its rules engine.

To request this feature, contact the CSC from athenaOne > Support > Success Community > Contact Client Support Center .

Note: The feature is department-specific so you’ll need to provide a list of the departments you want to enable.

Click here to learn about Notification-Driven Online Prepayment Plans.

Step 1 — Create prepayment plan type

Use the Prepayment Plan Types page to create the type of prepayment plan you need. All prepayment plans require a prepayment plan type (defined by your practice).

Step 2 — Create prepayment plan for the patient

From the patient's Quickview page, click the link to Add prepayment plan (under Insurances). On the Add Prepayment Plan page, you can specify the details for the plan — the total amount to be collected, the final due date, the payment schedule, and the expected provider, department, procedure code, and date of service.

Step 3 — Collect prepayments

To collect prepayments under the plan, use the Collect Payment page. From the Other Payment Amount reason menu, select Prepayment. The For Plan menu appears, where you can select the appropriate prepayment plan. This action ensures that the money collected is added to the prepayment plan balance and is not included in the patient's unapplied balance.

Step 4 — Apply prepayment balance to the charge for the designated service

After the patient receives the actual service, you can apply the prepaid funds either during charge entry or after the charges are billed:

- During charge entry — You can link a claim to a prepayment plan during charge entry at claim creation. The athenaOne system will automatically apply the prepayment balance to the adjudicated claim.

-

After the charges are billed — You can use the Post Payment page to apply the prepaid funds to the designated charges. On the Post Payment page, from the Payment menu, select the appropriate prepayment plan for the patient and charge (Prepay Credit — Plan <#>.').

Note: For patients with prepayment plans, the Method menu on the Post Payment page contains a prepayment plan option for each plan where the patient has a credit, in addition to the payment methods administered using the Payment Methods page. The prepayment options cannot be administered from the Payment Methods page.

Step 5 — Deactivate a prepayment plan

When the prepayment plan is no longer needed, you can deactivate it from various workflows:

- From the patient's Quickview page, under the Insurances heading, click the link to Deactivate prepayment plan. The Deactivate Prepayment Plan page appears, where you can select the Plan Paid in Full option and record any notes about the plan deactivation.

- On the Post Prepayment page, you can deactivate a prepayment plan and transfer any money remaining in the prepayment plan to unapplied.

- On the Prepayment Worklist page, you can find old prepayment plans with no patient balance or no associated claims, and then bulk deactivate them and move the plans' balances to unapplied.

The Prepayment Worklist displays the list of patients who have prepayment plans and any associated adjudicated claims or unadjudicated claims. On this page, you can:

- Access the Post Prepayment page, where you can apply prepayment plan money to adjudicated claims and link prepayment plans to unadjudicated claims for future posting.

-

Filter the Active worklist

-

Find plans with No Patient Balance

-

Find plans with No Associated Claims

-

Bulk select and bulk deactivate plans in a worklist

You can use the following reports to report on prepayment plan money.

You can use the Prepayment Plan Tracking report in the Report Library to identify payment trends in prepayment plans. This report shows you which patients have prepayment plans, how much money is being paid in advance of the patient visit, how much of the plan is covered by insurance, and more.

You can use the Activity Wizard and the A/R Aging Wizard to view all prepayment plans that have final balances due within a specified time period.

Activity Wizard

On the Activity Wizard page, click Advanced >>, enter the date range in the Start date/End date fields, select the Show unapplied amounts option, and run the report. At the very bottom of the report results, next to the label Change in Unapplied Patient Credit or Total Unapplied Patient Credit, you can review the data in these columns:

- Unapplied — The change in the patient's unapplied balance during the specified date range (this amount does not include the prepayment balance).

- Prepayments — The change in prepayments during the specified date range.

- Total Unapplied — The change in total unapplied (prepayments plus unapplied) during the specified date range.

A/R Aging Wizard

On the A/R Aging Wizard page, click Advanced >>, select the Show unapplied amounts option, and run the report. At the very bottom of the report results, next to the label Unapplied Patient Credit or Total Unapplied Patient Credit, you can review the data in these columns:

- Unapplied — The dollar amount of the patient's unapplied balance as of the specified date (this amount does not include the prepayment balance).

- Prepayments — The dollar amount of prepayments as of the specified date.

- Total Unapplied — The total dollar amount of unapplied (prepayments plus unapplied) as of the specified date.